2023 Estate Planning Update

Estate Tax Update Federal Estate Tax, Gift Tax and Generation-Skipping Tax Exemptions The 2023 federal exemption against estate and gift taxes is $12,920,000 per person. This is an increase over the 2022 exemption, which was $12,060,000 per person (the increase reflects an inflation adjustment). The exemption is expected to drop by 50% at the end […]

September Tip: Update Your Estate Plan

2023 Estate Planning Guides ⋆ Joseph L. Motta Co.

January 2024 Newsletter - Trust Company of North Carolina

10 New Year's Estate Planning Resolutions for 2023

Estate Planning Roundup: 2023 Updates and the Urgent Need to Utilize Exemptions

The 2023 Estate Planning Practice Report

2023 Annual Estate Planning Limits

Minimize Taxes, Maximize Your Estate's Potential: Seminar Unlocks Secrets of Estate Planning – Pasadena Weekendr

5 Reasons to Update Your Estate Plan

The Clarity Formula® - Estate Planning: An Updated Guide for 2023 Estate Planning - HCR Wealth Advisors

Estate Planning: Protecting Your Legacy - Oct. 24 - Alaska Public Media

Estate Tax Planning Tips For 2023

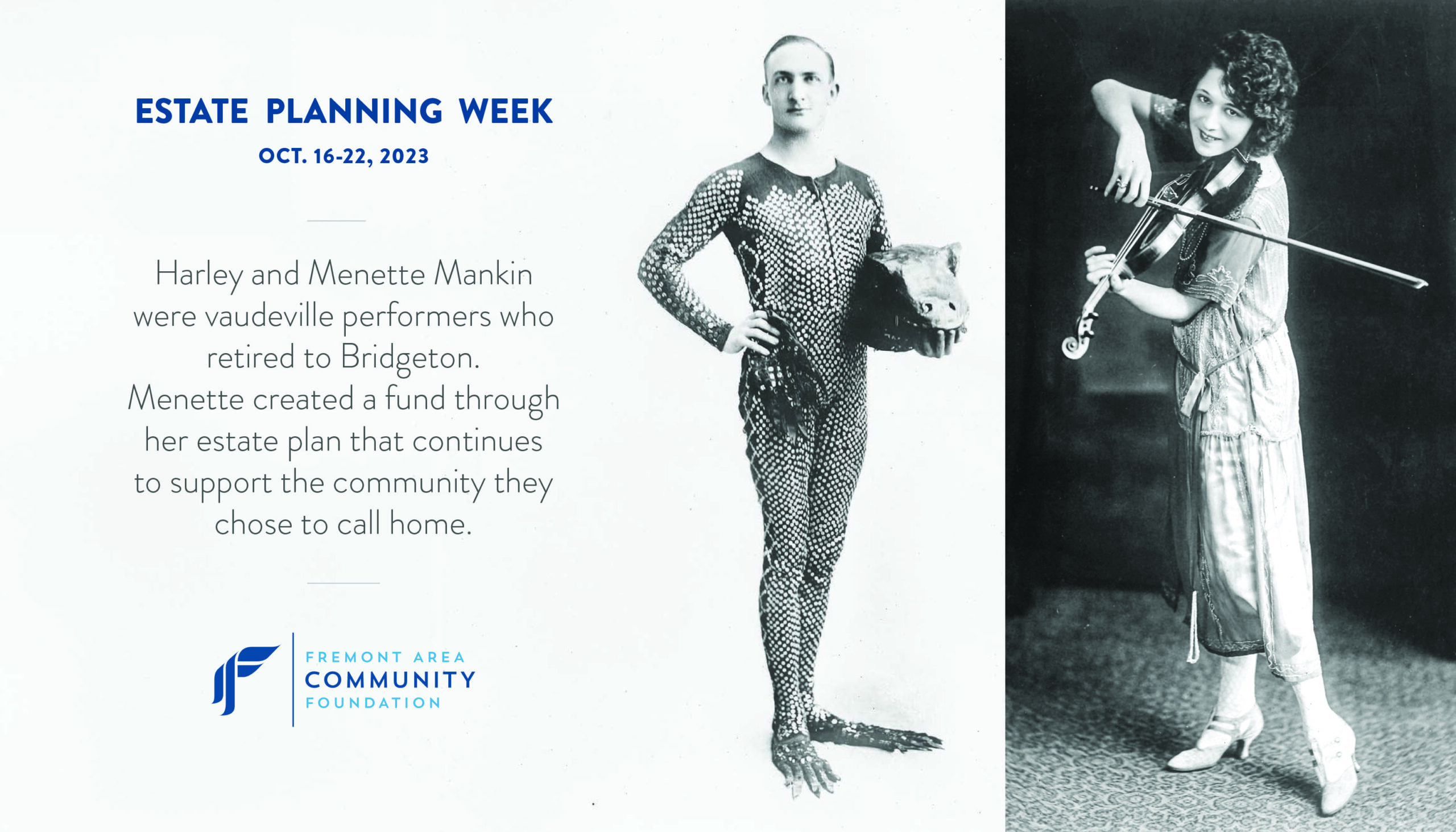

Estate Planning Week 2023

2024 IRS Updates to Inflation-Adjusted Numbers for Estate Planning

2023 Estate Tax Exemption and Gift Tax Exclusion Update (Video) - Litherland, Kennedy & Associates, APC, Attorneys at Law

;)